Recently, household security finance have gone how out-of boy bands. Therefore past-century. Into the a get older regarding low interest, home equity credit lines and money-out refinances had been the newest security-tapping issues preference.

Home collateral credit lines, or HELOCs, have been in existence because they usually are constructed with low basic rates, which have been scraping the base. Cash-aside refis was in fact needed since the having home loan prices within an excellent historical floor, an incredible number of property owners have been refinancing to lower their rates and you may tap the fresh security within their home.

Plain-and-easy domestic guarantee loans, for the safeguards out-of a closed-from inside the interest you to never ever alter, was basically yesterday’s news. However, due to the fact discount enhances and you may rates of interest rebound, you might have to go throwback should you want to access some of your property worth.

Control stalled domestic collateral loans

At the least some of the fault towards forgotten house equity finance can be placed into the regulation. Dodd-Honest, this new large-ranging monetary change act instituted this current year, required one loan providers change statements and you can disclosures having home collateral finance, however having HELOCs.

They called for lenders to implement thorough system transform, and as a result, some people chose to eliminate household security loan issues. And, low interest rates and rising home values left loan providers busy which have re-finance request and you will HELOCs. Banking companies and you can individuals had no need for the excess records requisite with the house security funds.

Rising interest rates may changes request

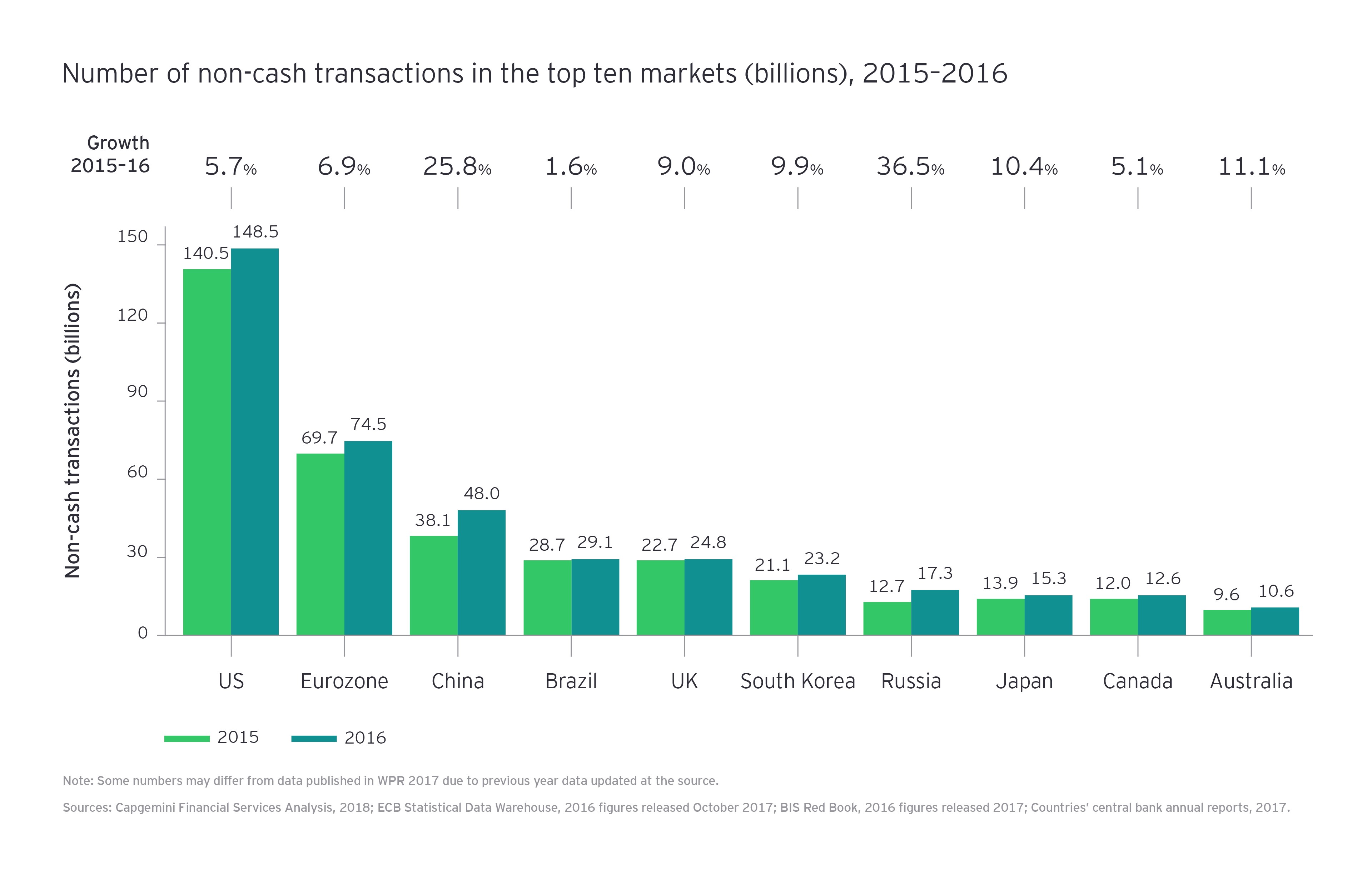

Home loan pricing was in fact significantly less than 4% for everyone however, a couple months for 2015 and you can 2016, centered on Freddie Mac. installment loan companies in Los Angeles CA Although sunrays seems to be means to your sub-4% financial rate.

Logan Pichel, head of consumer credit to have Countries Financial, believes that as rates rise, more people may back off regarding a change-upwards mindset. According to him property owners when you look at the 2017 and you may past get envision building work the existing domestic – having its already low financial speed – as opposed to to get more substantial domestic in the a higher rate of interest.

Pichel predicts of several people will say, I am not saying planning move up to your second big domestic as I’m seated right here today on the an excellent step three step 1/2% home loan rate, and if I was to offer my house and you will go get another, We have good cuatro step 1/2% home loan rate. A home guarantee financing allows people people to up-date a kitchen, include a bedroom or generate a backyard living area, for example.

Sufficient reason for costs expected to go on months ahead, this new cousin advantage of a good HELOC having a decreased basic speed isn’t as clear since it is likely to improve when occasional price resets activate.

Our advice is actually, we shall find fewer circulate-up people and you will we’re going to select a lot more family security company as a result of the upsurge in interest levels, Pichel says.

I think we’re going to get a hold of a change back once again to fixed security loans, Camarillo claims. Our users are more fiscally conventional, plus they including the protection out of knowing that my personal payment is definitely gonna be X amount of bucks.’ Especially if they already know that they usually have a specific objective for their financing.

Repair it and tend to forget it

Upcoming choice, Pichel claims, the second circulate is to select from a home collateral mortgage and you may a property security credit line. HELOCs usually begin with a somewhat all the way down rates than fixed-rates home security fund.

But HELOC prices are commonly varying and you may susceptible to the fresh new ups and you may downs of short-name interest rates, about initially. Of many lenders allow consumers in order to carve out a portion of their equilibrium owed and place they for the a fixed-price mortgage.

Because you see a rise in rates of interest, you will have a couple of individuals who will say, Guess what, I’m going to secure from the a fixed rates,’ he says.

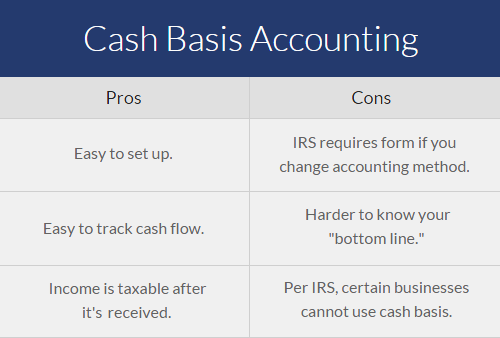

- They are aware just what the payment per month might be, that helps having cost management.

- Scraping household guarantee having a lump sum rather than owing to an excellent line of credit eliminates the new urge to expend off and mark money from the fresh new line again.

- With a set level of costs, individuals knows their incentives day.

Certain people such as for instance knowing the real wide variety. Navy Federal’s Camarillo says you will find a comfort and ease that have knowing the certain quantity you can easily owe, how much time it will take to pay the loan away from and you will exacltly what the fee was each month.

Recent Comments