This new Impression of Bond Sector

The bond industry, and particularly the latest 10-12 months Treasury give, together with affects financial prices. Generally speaking, bond and you will interest levels commonly relocate the alternative guidelines. This means that increases within the field prices normally associate having thread costs losing, and you can vice versa.

Bank Considerations

Past exterior things that are beyond a good homebuyer’s control, personal facts and affect the rates they will discover whenever using getting home financing. The second circumstances is at the top of notice off loan providers every time you submit an application for an alternative mortgage or refinance loan.

- Credit score: People with most useful borrowing can qualify for all the way down financial costs full with quite a few mortgage models.

- Downpayment: Huge down money can help people secure a lower mortgage rates.

- Rate of interest Kind of: The possibility between a fixed interest rate and you can an adjustable you to make a difference to the rate you only pay.

- Amount borrowed: The price of property and you may amount borrowed may play a job for the financial costs.

- Mortgage Term: Shorter-term home loans commonly come with straight down rates than funds which have longer repayment words.

- Financing Type of: The kind of mortgage your submit an application for make a difference their financial speed, whether you go searching for a traditional mortgage, Government Casing Management (FHA) financing, installment loans for bad credit in Jacksonville PA U.S. Institution regarding Farming (USDA) home loan, otherwise Virtual assistant financing.

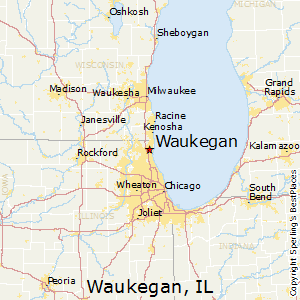

- Location: Particular aspects of the nation provides higher otherwise all the way down home loan rates full.

Based on Freddie Mac computer, financial costs peaked in Oct of 1981 in the event the average rates towards the 31-year, fixed-rate mortgages try %.

How frequently If you Contrast Financial Rates?

Evaluate home loan pricing should you decide to pick otherwise re-finance a property. You happen to be able to find lower pricing with loan providers as opposed to others for those who shop around.

What is the Development in the Mortgage Prices Given that 2020?

Home loan rates was indeed currently relatively lowest in the event that pandemic hit-in 2020, however, pricing dropped also down because of changes toward provided money speed started by the Given inside the 2020 and you may 2021. Mortgage pricing features much slower already been hiking from the time.

Is also Home loan Prices Previously Slide so you’re able to Zero?

As the mortgage pricing customers pay can never fall so you can zero, the new fed financing speed might have been alongside zero ahead of. In fact, the fresh new federal money speed fell only 0.05% for the .

How do Changes in Home loan Cost Apply to Refinancing?

Changes in financial rates affect the price you are going to need to shell out to refinance your home loan. This is exactly why mortgage refinancing grows whenever pricing lose and you can software getting refinancing mortgage decrease whenever rates is high.

The bottom line

Today’s home loan prices commonly as little as these people were regarding the very early 2020s, however, these include nonetheless relatively lowest once you take a look at historical averages. Actually, financial costs was basically highest in the seventies towards the 2000s in advance of briefly dropping immediately after which progressing away where he’s now.

Irrespective, homeowners haven’t any control of the average mortgage rates. They merely enjoys control of the private products you to definitely pertain when to purchase or refinancing a house, such as for instance the credit rating, down payment (having property buy), and the types of mortgage they sign up for. The best move really people produces prior to taking out a good mortgage gets her monetary family managed, which could were increasing its credit history and you may looking around in order to find a very good cost available.

New Fed several times enhanced the brand new given financing speed so you’re able to combat rising inflation during 2022 and 2023, that has added me to the present mediocre mortgage rates (since ) regarding six.87% having 15-12 months, fixed-rate mortgages and you can six.13% to have 31-12 months, fixed-speed loans.

Recent Comments