Borrowing building playing cards may help to resolve small-term income trouble. A credit builder cards is worth given if you would like an excellent short loan but i have lower income or bad credit. These cards enjoys lower borrowing from the bank limitations but are likely to enjoys a lowered interest rate than a payday loan otherwise home financing.

You’ll need to pay back the bill timely plus in complete each month to create your credit rating. Or even, you can chance further destroying your credit rating.

Taking an unsecured loan can sometimes be hard when you have a low income, so your selection are limited.

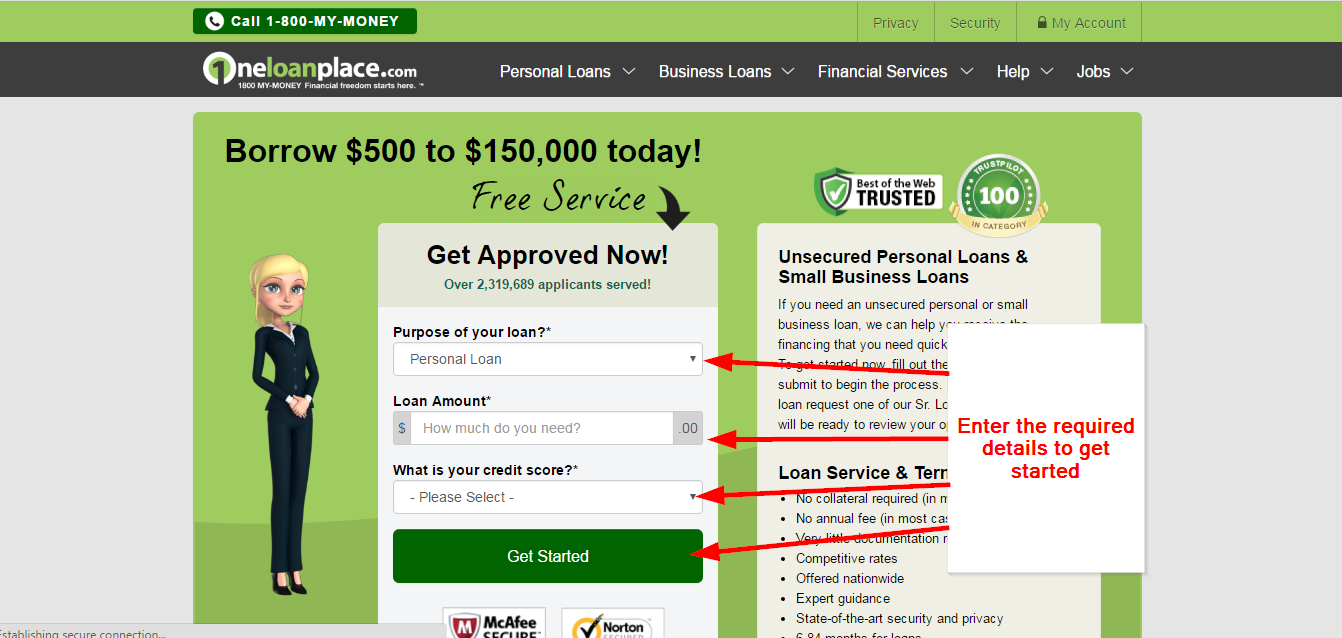

The best low-earnings finance are often aquired online of an immediate lender or a comparison web site including ours – we can make it possible to meets your which have various lenders otherwise agents designed for the monetary need.

You might implement personally for a financial loan off a premier street lender, however your application may get refused, and https://availableloan.net/loans/emergency-cash-for-single-mothers/ you may tabs on a painful credit score assessment is left on your own credit report. Multiple of them from the space from six months could harm your credit rating.

Can i get that loan basically have little income and less than perfect credit?

It’s possible, but money for those who have reasonable revenue and you will bad credit commonly often feature high rates of interest, and thus possible pay way more inside focus, that renders credit more costly to you personally.

While you are comparing funds, check the Apr (APR). The higher this new Annual percentage rate, the greater amount of your loan will cost you total.

Exactly what are the pros and cons out of getiing a minimal-money financing?

- It’s easy to get that loan on the web

- Fund shall be readily available easily while you are acknowledged

- Would be less expensive than a credit card or overdraft

- Could help that have budgeting since the money are repaired to own a flat months

- Will get boost your credit history for many who pay off timely and you may in full

- Low-money fund often include large APRs, making the price of borrowing costly

- You have got to stick to repayment terms otherwise chance charges having shed or later payments

- Deciding on a lot of loan providers from inside the a short span of your time usually impression your credit score

- Your chance weakening debt problems if you’re unable to pay off your loan

Are there any possibilities so you can money for people with tight budget?

If you have coupons, they elizabeth to make use of all of them, however it wouldn’t cost you something as compared to notice regarding financing, and constantly build your deals back up once again.

As an alternative, you might want to believe talking to friends or household members just who could possibly give you currency for folks who just need in order to obtain a small amount to have a brief period of time.

While a citizen, you might want to thought talking to their home loan company regarding getting a mortgage payment escape. This could provide particular quick-identity finance, regardless of if you will have to pay off a whole lot more four weeks because payment break ends up to pay for huge difference.

If you need to use a larger sum, the mortgage lender could possibly provide you with a great remortgage offer that can free up fund. Remember this will suggest you end up expenses far more demand for the future, that will add to the cost of your own mortgage.

In the long run, while unable to manage otherwise has debt concerns search assist of a personal debt-let foundation, such as for example Citizens Information or perhaps the Federal Debtline.

Low-income financing Faq’s

For many who miss otherwise generate later payments on that loan, you may have to pay late fee fees, that’ll add to the debt and you may likely wreck the borrowing from the bank rating.

Recent Comments