For almost all potential customers, the largest test to buying a home are preserving upwards for this new down payment necessary to get a home loan. Your own initial prices is frequently 1,000s out of cash, according to the house’s purchase price as well as the minimal commission necessary on down-payment. Higher down repayments became typical whenever home prices averted admiring such as for example it used to and you can lookup showed that the greater amount of currency a buyer invested in a property, the latest not likely he would standard into the their financing, given that he failed to want to reduce their 1st financing. Thus, partners lenders provide zero-off otherwise 100% capital home loans any further and typically want 20% down, in case the credit rating is not adequate to get individual home loan insurance coverage (PMI). not, some apps still allow you to get property as opposed to an excellent deposit, for folks who see particular conditions short term loans with bad credit Benton.

USDA Financial

The us Institution from Agriculture Rural Invention Solitary Family unit members Property Mortgage Verify System, more commonly referred to as an excellent USDA home loan, provides acknowledged lenders having good 90% make certain toward certified house buyer money. So it decreases the lender’s’ chance and you can allows these to render 100% capital so you’re able to eligible applicants. For folks who meet with the USDA’s borrowing and earnings standards, as well as the house you would like is actually among areas eligible for their no-down-commission program, you are on your way to homeownership. In the place of traditional real estate financing that need PMI with off repayments lower than 20%, a USDA financing keeps an initial percentage, constantly dos%, in lieu of PMI, but you can roll this count to your loan amount, instead of using it ahead of time. That is a national-recognized program home buyers have been using because 1949 to invest in homes they might perhaps not afford because of antique streams.

Va Mortgage

The fresh Company away from Experts Factors also offers Virtual assistant lenders to qualified active-duty military personnel, experts and you may certain members of brand new National Protect and Reserves. Like USDA mortgage brokers, personal lenders give 100% financing to help you eligible homebuyers, as the funds was secured because of the Virtual assistant. Such funds have an initial financial support commission, in lieu of PMI, that you can increase your loan amount. As long as the newest price point doesn’t exceed the latest home’s appraised worth, a downpayment isn’t expected. Virtual assistant loans as well as limit the number you will end up recharged for settlement costs, which can be paid back by provider, if they want to do so. Also, if you encounter problems while making their mortgage repayments, the fresh Virtual assistant is able to advice about individuals foreclosure reduction selection.

Navy Government Borrowing from the bank Union Home loan

Navy Government Credit Union (NFCU) is the premier borrowing from the bank relationship in the united kingdom and you will qualified participants feel the added brighten regarding 100% investment with its first-date domestic client program. Qualifications to have membership on the credit commitment is limited to help you productive-obligations or resigned armed forces staff, specific civilian professionals of the armed forces or You.S. Agencies of Safety, otherwise family relations of eligible players. Due to the fact an effective NFCU user, you may also qualify for a fixed-price otherwise adjustable-rate mortgage with no down payment called for. Many finance plus wouldn’t want PMI, as well as it is “All of the Solutions” financing, hence require a funding percentage you might fund in your mortgage. The NFCU is also a prescription Virtual assistant mortgage lender, if you need to make use of their program.

FHA Financial

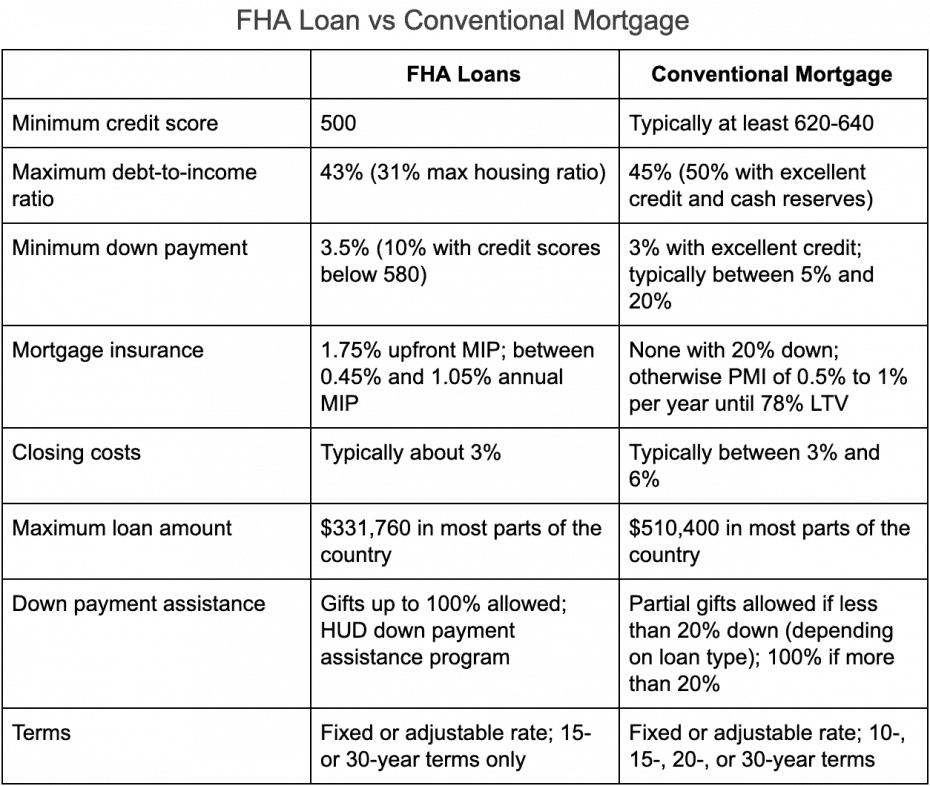

When you’re Federal Housing Government (FHA) finance you should never provide 100% funding, at only step 3.5%, the required advance payment fee is much less than antique home loans. As well as, if a person in all your family members, a low-profit team or any other qualified resource is prepared to shell out your own downpayment, FHA direction enables you to discover monetary merchandise to fund their whole down payment. You can easily have a decreased down-payment, you may not have to blow it your self. Furthermore, through the Good neighbor Nearby (GNND) effort, public-market personnel for example instructors, law enforcement officers, firefighters and emergency medical mechanics you certainly will be eligible for residential property during the fifty% from the typical list rate with the absolute minimum down-payment away from only $100.

Recent Comments