Find out hence debts might possibly be discharged after your own Chapter thirteen bankruptcy cost package period.

Part thirteen bankruptcy makes you get caught up on the skipped home loan otherwise car loan repayments and you will reconstitute your debts thanks to a fees plan. After you done their plan, you’ll located a section thirteen discharge that eliminates the majority of your kept bills. Continue reading for additional info on which debts might be released within the Section thirteen bankruptcy.

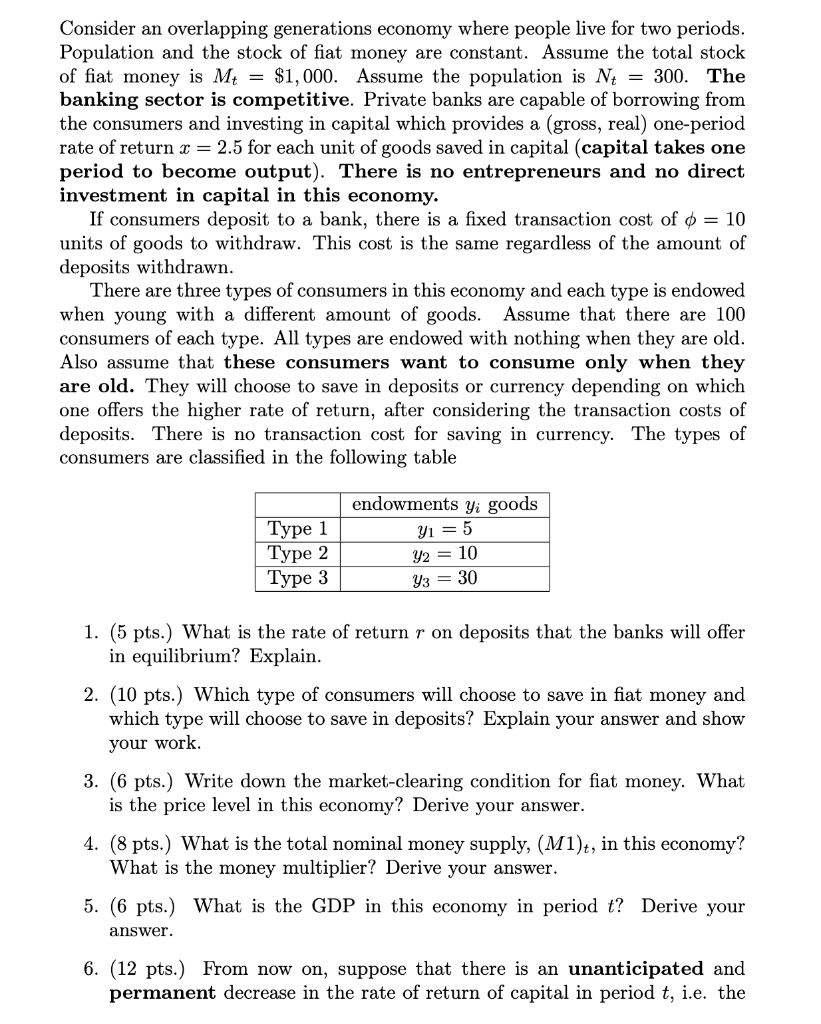

Extremely Nonpriority Unsecured outstanding debts

In the place of consideration states-expenses that get paid before most other personal debt-very nonpriority un-secured debts discovered zero unique therapy when you look at the personal bankruptcy. Unless of course new collector can be which you put fraud otherwise not the case pretenses to obtain the debt, most style of nonpriority unsecured financial obligation are dischargeable during the Section thirteen bankruptcy.

- credit card debt

- medical bills

- personal loans

- earlier nonpriority income tax loans

- bills, and you may

- extremely suit judgments.

Bear in mind, although not, that you’ll probably spend a fraction of this type of debts because of your Part 13 package. The fresh court discharges the remainder balances after their cost several months.

Covered Expenses That will be Crammed Down otherwise Removed

In general, a bankruptcy proceeding discharge cannot lose liens from the property. When you yourself have home financing or car finance, your own lender has actually a security need for your home. For those who stop and come up with your repayments, the lending company normally foreclose on the home or repossess your vehicle even with their release.

Section thirteen will save you your residence, yet not. For individuals who fulfill certain criteria, you will be capable get rid of loan places Romeo a wholly unsecured junior lien (particularly the next home loan) using lien stripping otherwise slow down the a good balance out-of almost every other protected costs (eg a car loan) which have a chapter 13 cramdown.

For people who strip a junior lien from your own home, it will be categorized because a beneficial nonpriority consumer debt in your bankruptcy and you will removed once you discover your own release. Once you stuff off an auto loan or any other secured loans, the mortgage was divided in to protected and you will unsecured portions. You need to pay off this new covered piece throughout your installment package. But the unsecured area was damaged after you complete the bundle acquire a discharge.

Bills Released for the Section 13 Bankruptcy proceeding Simply

A section thirteen bankruptcy launch allows you to dump specific costs that aren’t dischargeable into the A bankruptcy proceeding case of bankruptcy. Listed below are a few of the most well-known expense you might get rid of into the Chapter 13 personal bankruptcy although not in the A bankruptcy proceeding:

- bills developing out of willful and harmful harm to possessions

- debts accustomed spend nondischargeable tax personal debt

- costs incurred as a result of a property settlement contract in divorce or separation process (just remember that , debts classified as assistance financial obligation instance alimony otherwise youngster support aren’t dischargeable)

Bills Section thirteen Doesn’t Cancel

You need to pay-off particular personal debt completely during your cost bundle no matter your earnings and you may property. Continue reading for additional info on and this debts you should spend back to complete via your Chapter thirteen plan.

Priority Debts

Specific personal debt (entitled priority bills) discovered unique medication during the bankruptcy. Priority expenses cannot be discharged (eliminated) from the filing for bankruptcy. If you have consideration debt, you need to outlay cash off completely during your Chapter 13 fees plan. Quite often, Part thirteen bankruptcy will bring debtors a convenient and affordable means to fix pay the top priority expense more a around three- to four-year months. But when you has too much consideration bills, your monthly bundle payment must be adequate to invest them off in this five years.

The most famous examples of top priority costs is particular income tax expense and home-based assistance debt such as alimony or youngster assistance. Know about concern, safeguarded, and you will personal debt into the bankruptcy.

Mortgage Arrears

While you are trailing on the home loan repayments and wish to maintain your household, you should repay the mortgage arrears through your payment plan. It is perhaps one of the most popular debts paid off as a consequence of an installment package since of a lot debtors file for Section 13 bankruptcy proceeding to catch through to skipped mortgage repayments and help save their homes. However, understand that you ought to always build your ongoing mortgage repayments on the lender if you are catching up in your arrears using your plan.

Otherwise plan on keeping your house, you don’t need to were your own financial arrears on your plan. You might surrender the house to the bank, as an alternative. Together with, if you have the second financial or any other junior lien on the your home that you decide to beat as a result of lien removing your don’t have to repay brand new arrears thereon financing.

Car and truck loans or any other Covered Expense

You can always give up your car or truck and you will eliminate the loan. But if you need to contain the auto, you will have to shell out the dough. If you should pay-off your car or truck mortgage or any other protected costs throughout your Part 13 bundle-in lieu of outside of the package-depends on the guidelines on your jurisdiction. Should you want to keep vehicle, some case of bankruptcy courts assists you to remain and also make repayments really into financial away from personal bankruptcy. Anybody else may require you to pay your vehicle loan because of the repayment package. If you find yourself trailing on your own car loan payments otherwise wanted to attenuate the loan harmony compliment of a good cramdown, you should were your vehicle financing on your own payment plan. Find out about Chapter 13 therefore the 910-day-rule towards the auto loans.

Administrative Claims

Management says receive money from the repayments over the lifestyle of your own package. For instance, the Chapter thirteen trustee obtains a portion of your own bundle percentage (doing 10%) just like the payment to own administering the situation and you can publishing repayments to the creditors. And, for many who hired an attorney, you accessible to spend some of the attorneys’ charge initial additionally the sleep via your cost plan.

Whenever Might you Receive a chapter 13 Release?

For folks who declare Chapter 13 case of bankruptcy, you have to make monthly premiums so you can a case of bankruptcy trustee for three so you can five years with regards to the regards to the fees bundle. You get the release after you done every required plan payments.

Recent Comments