A home security loan with good cosigner may help boost your probability of bringing a property security financing than the applying on the your own.

Life is unpredictable. Unforeseen some thing appear that require that you create significant monetary decisions, for example although a house guarantee loan that have a great cosigner is right for you.

Facts exactly what a property security loan is, your own together with cosigner’s jobs, and just what app and fees techniques involve allow you to make the best choice regarding the existence and financial coming.

During the RenoFi, we endeavor to let residents see their borrowing from the bank options. This informative guide commonly address some of the most crucial questions you possess away from delivering a property equity loan which have an effective cosigner, what things to think, and you can what to anticipate $255 payday loans online same day Texas from the techniques.

What’s a property Security Mortgage?

Residents may use its home’s guarantee given that collateral to get a beneficial family equity financing. It is considered an extra home loan on your own family.

It is essential to observe that collateral does not equal your home’s worthy of. To choose their house’s security, you are taking the brand new house’s well worth and you may deduct your balance into the home loan. Look at the guarantee because currency currently paid towards household.

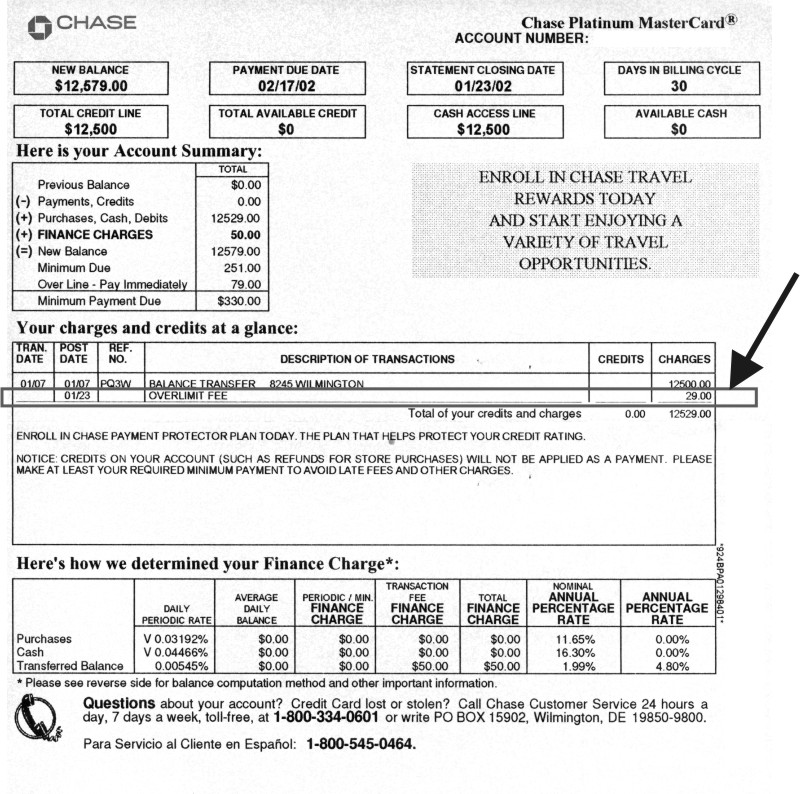

While you are almost certainly aware of many pros the most significant becoming that you will get a lump sum of cash to use for their need mission you’ll find risks inside it. A property guarantee financing is even perhaps not totally free. It can almost certainly incorporate a fixed interest rate and differing fees. Family security lenders are generally initial throughout the these quantity, so you can bundle accordingly.

What’s the Part out-of good Cosigner?

An effective cosigner essentially shares the possibility of our home equity loan for the candidate. For folks who, due to the fact resident, usually do not pay the house collateral loan just like the conformed, the cosigner are lawfully in control.

Cosigning to possess property collateral financing can be definitely connect with their borrowing from the bank report, but when you, once the resident, dont stick to the regards to the loan towards the cosigner, it does adversely perception its credit rating. Your cosigned domestic collateral mortgage shows up for the both your and its credit history.

Exactly what can You use our home Equity Financing To have?

Property guarantee mortgage are used for just about anything, including strengthening an urgent situation money, starting home improvements and position towards the family, or even performing a corporate. You get the money all together lump sum payment rather than private repayments.

What In the event that you Make use of the House Security Loan To possess?

You should use the loan your objective, but as it is one minute home loan on your domestic and can apply to your own borrowing and therefore of your cosigner, you might want to use it getting called for, extreme expenditures as well as for an expense you can afford to expend back.

Such as for example, having the currency to be on a merchandising spree getting costly attire things or even to purchase a car or truck may not be inside the the best economic notice. But not, it can be best for make use of the money to own a corporate options or even reduce other obligations.

Is Applying Having an effective Cosigner Most effective for you?

The new cosigner need certainly to build a giant decision from the whether to get with the obligations of your obligations, considering he’s got no command over just how, when, just in case you make your payments. Signing towards the dotted range suggests that they faith one proceed with the payment relationship.

But not, you additionally have to determine if you are prepared to neck that weight first off. Its something to bring the extra weight away from debt, but it’s yet another to know you are taking others in it.

Recent Comments