Posts

The term “401(k)” ‘s the code your Irs, Irs, has given to that particular type of later years package. You should know the distinctions in the financing options and you will threats, fees and costs, taxation ramifications, services and you can punishment-100 percent free distributions for your certain choices. Speak about the benefits package, in addition to items like unlimited time away, overall health benefits, designed knowledge and you may advancement options, and retirement preparations. Mention certain perks, such as-family childcare business or an adaptable date-out of policy. Dominating also provides small-name disability insurance in most says. Speak to your economic elite group to style a benefit providing one fits the demands of your business and group.

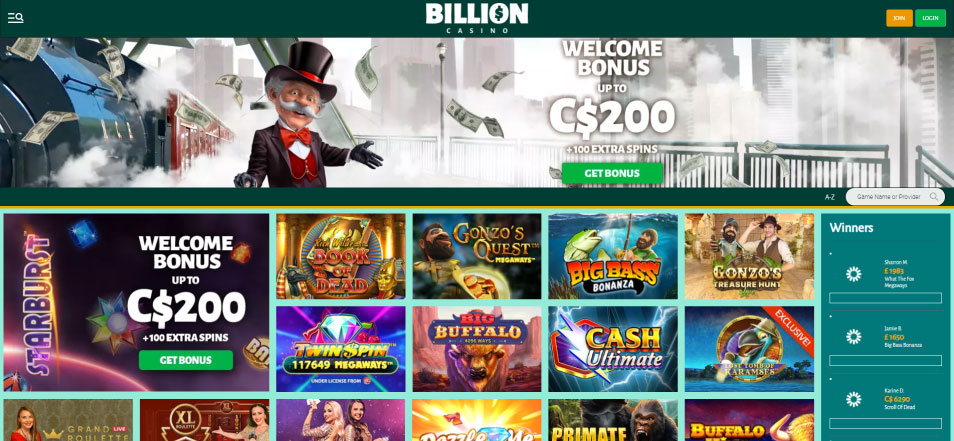

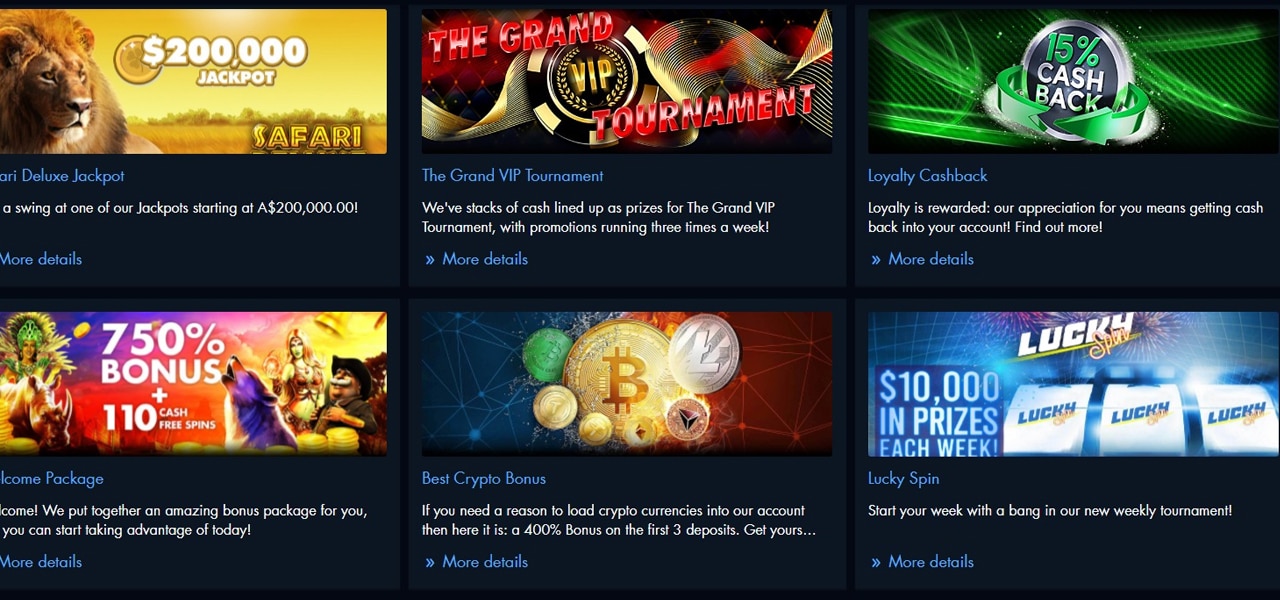

Bitcoin casino no minimum deposit: The fresh feel

Short-term disability insurance may help act as a personal back-up for staff once they’re too ill or damage to work. We’lso are purchased performing a brighter future to own monetary features. You’ll let provide access to economic inclusion, support 1000s of increasing enterprises, and you may certainly effect the community. The fresh Later years Fitness Score means a quotation of your part of the pre-later years money you have offered once you retire. That it number helps you see if your’lso are on track with your offers needs.

Understand it or any other points you to definitely dispel common objections so you can variable annuities. Let’s cap of so it deep diving to the tips produce a webpages reliability technologies jobs malfunction with many faqs from the site accuracy designers. Ability examination do more vouch for your own applicants’ feel. However they let you look at their society include potential, and just how better they’re going to serum and you will subscribe your online business ethos. Show the identity, world, goal, and sight, and you may mention your merchandise. Don’t forget to mention specific success and you may goals relevant to an excellent webpages precision engineer.

How can i complete an excellent rollover?

This can be a terrific way to be mindful of their savings with you to definitely membership join. To see if this package is available, talk with the package member otherwise human resources affiliate. In your staff professionals, your employer may offer to make a share to your retirement savings account based on the matter your in person contribute. Your boss might have several reasons why they generate a matching contribution on the retirement savings. Talk to your human resources company see if your employer also offers a corresponding share and you will what you can do when planning on taking benefit of it.

- We highly recommend your read more about how investment focus on the site otherwise receive suggestions out of your financial professional or our very own senior years specialists.

- Advantage allowance doesn’t make certain a profit otherwise avoid a good loss.

- Gained earnings setting anything you make out of doing work, such as earnings, salaries, otherwise information.

- Morningstar Funding Management LLC isn’t an affiliate marketer of every organization of your own Principal Financial Group.

- Recipient designations try judge designations required and when a professional later years package will bring benefits to beneficiaries away from inactive professionals.

- You will want to speak with compatible counsel, financial pros, and almost every other advisers for the all of the issues over legal, taxation, funding or accounting loans and requires.

You can withdraw money, penalty-free from the ages 59½, otherwise prior to for certain challenges, so long as you implemented the guidelines out of a good Roth IRA. The fresh quick response is sure, however, there are some important considerations to that particular choice, particularly it can’t become undone. Delight request a tax top-notch to comprehend the taxation effects. Providing you are entitled to income, you can sign up to a great Roth IRA. Attained money function any money you make away from doing work, such as wages, salaries, or information.

Help with on the web usage of yours membership

The company’s retirement plan investment choices could have financing costs below equivalent funding choices provided away from package. There is other factors to consider due to your specific needs and you may situation. Some preparations get will let you generate Roth and you will/or immediately after-tax efforts to your old age checking account. If that’s the case, you will do pay taxation for the currency right after you lead they.

Collateral money possibilities cover greater risk, and increased volatility, than just fixed-money investment alternatives. Fixed-income assets try at the mercy of rate of interest risk; while the interest levels go up the worth bitcoin casino no minimum deposit have a tendency to refuse. Small and mid-cap brings have extra threats and better rates volatility. Global and globalinvestment choices are subject to extra chance because of changing exchange rates, overseas bookkeeping and financial principles, or any other monetary and you can political surroundings.

Please be aware you to shared fund available to U.S. people come thanks to Dominant Financing Distributor, Inc. You want to live really when you retire—and even though you’re also making it. To possess protection reasons, we really do not recommend by using the “Keep me logged inside” solution for the social gizmos. Or if you only want to stand latest to your team development, incidents, and you may career possibilities, subscribe the Talent Network. You will see the unlock jobs positions or make use of the pursuing the search form to get perform that suit your specific career welfare. This site isn’t a great solicitation of interest in every from these products in just about any other state.

The fresh Morningstar label and image is actually inserted marks from Morningstar, Inc. That it survey emerges while the knowledge and you may informative only. As the a retirement bundle fellow member, you need to check with your financial professional concerning your responses to so it questionnaire and other related items that you should imagine ahead of making an enthusiastic allotment decision. The niche count inside correspondence is informative merely and you can offered to the with the knowledge that Prominent is not leaving court, bookkeeping, money guidance or taxation suggestions. You ought to speak with appropriate guidance or any other benefits on the all things around courtroom, income tax, financing otherwise bookkeeping personal debt and needs. That it calculator merely provides knowledge which are helpful in and make individual economic conclusion.

Key jobs info

The fresh member enterprises of one’s Dominant Monetary Class neither endorses, clearly or impliedly, some of the alternative party organizations. 1 You’re also at the least decades 59½ and also the currency has been doing your bank account for around 5 years. Just like the storage rooms, our very own financial existence might require a keen organizational change. Here you will find the ideas to cleaning clutter in terms of your finances. We provide multiple annuities to meet the various monetary requires of your subscribers.

Which or any other info is included in the 100 percent free prospectus and this can be acquired from the local affiliate otherwise online during the prominent.com. Delight check out the prospectus and, if the readily available, the new bottom line prospectus meticulously prior to investing. One strategy for every area leaders group is always to focus on are prominent oversight, a button lever to possess improving university leaders and you may preserving a strong management tube. Whatsoever, outside of the classroom teacher, the primary is the next extremely important personnel in order to impression outcomes for pupils. “403(b)” describes a form of later years discounts plan which can be offered to specific staff from social universities otherwise specific tax-exempt communities. A 401(k) is one form of later years offers bundle that would be provided by the employer.

Old age deals plans make it easier to set aside money now that you are able to use to aid replace your operating earnings within the old age. A retirement deals bundle is going to be given through your workplace where your lead a percentage of the salary—generally prior to taxation, when you might have extra share types on the market. The bucks will be spent considering forget the allowance to help you the brand new money available options through the package. How much you may have to save is founded on your private problem along with your desires for the future.

Asset allocation cannot ensure a profit or stop a good losses. Fixed-earnings and you will advantage allocation investment options you to invest in financial ties are at the mercy of improved exposure because of a property exposure. Opinion the new RetireView Terms and conditions for the full dialogue from the advantages of the provider, as well as rebalancing and you may automated years changes of your own inhabited models.

Recent Comments